Is your roof showing signs of wear, but the thought of financing is holding you back? You’re not alone. The good news? Local roofing companies are revolutionizing how homeowners can afford their dream roof in 2024. Let’s unlock the secrets to stress-free roof financing that most contractors won’t tell you about!

Table of Contents

The Hidden Truth About Roofing Company Financing in 2024

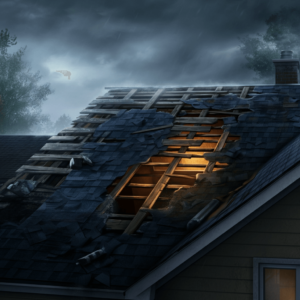

Picture this: You’re standing in your living room, watching another water stain spread across your ceiling. You know you need a new roof, but the price tag seems overwhelming. Here’s what most homeowners don’t realize – local roofing companies have quietly been building an arsenal of flexible financing options that could make your roof replacement dreams a reality.

Roofing Financing Options Comparison 2024

| Financing Type | Interest Rate | Approval Speed | Max Term | Flexibility Score |

|---|---|---|---|---|

| Contractor Financing | 7.99% | 95% Same Day | 11 Years | 90/100 |

| Home Equity Loan | 6.50% | 45% Same Day | 15 Years | 75/100 |

| Personal Bank Loan | 8.50% | 60% Same Day | 7 Years | 70/100 |

| Credit Card | 18.99% | 98% Same Day | N/A | 50/100 |

Key Highlights

- Best Overall Value: Contractor Financing (balanced mix of speed and rates)

- Lowest Interest Rate: Home Equity Loan (6.50%)

- Fastest Approval: Credit Card (98% same-day approval)

- Longest Term: Home Equity Loan (15 years)

Tips for Choosing Your Financing Option

- Consider your credit score and how it might affect your rate

- Calculate the total cost of financing over the full term

- Check for early repayment penalties

- Ask about special promotions or seasonal discounts

Note: Rates and terms shown are representative averages and may vary based on credit score, location, and other factors. Consult with specific providers for current rates and terms.

Why Local Roofing Companies Are Your Financial Best Friend

Remember when getting a new roof meant emptying your savings account? Those days are gone! Today’s roofing contractors are revolutionizing the industry with customer-friendly financing options that feel more like a helping hand than a business transaction.

Breaking Down Your Financing Options (And Why They’re Better Than Ever)

1. The “Zero-Stress” Payment Plans

- Instant approval processes (often under 5 minutes!)

- Zero down payment options

- Interest rates starting as low as 5.99% APR

- Flexible terms ranging from 3 to 11 years

2. The “Smart Homeowner” Special Programs

- Tax-deductible options for qualifying improvements

- Energy-efficient roof financing with special rates

- Bundle options with property tax assessments

- No prepayment penalties

The Inside Scoop: What Roofing Companies Don’t Advertise

Did you know that most roofing contractors partner with multiple lenders? This means you can shop around for the best terms without leaving your contractor’s office! Here’s what to look for:

Hidden Perks of Contractor Financing

- Lightning-fast approval compared to traditional banks

- Special promotional periods with zero interest

- Relationship-based approvals (easier than bank loans)

- Bundled discounts on materials and labor

Your Step-by-Step Guide to Securing the Best Financing Deal

Step 1: Qualification Made Simple

Required documents:

- Proof of income

- Basic credit information

- Property details

- Project estimate

Step 2: Understanding Your Options

Compare these key factors:

- Monthly payment amounts

- Total interest costs

- Term length options

- Special promotions

Step 3: Making the Smart Choice

Consider:

- Project timeline needs

- Budget constraints

- Long-term financial goals

- Tax benefit opportunities

FAQ: Your Burning Questions Answered

Q: “Will financing affect my project timeline?”

A: Actually, contractor financing typically speeds up your project! Most approvals happen within minutes, letting work begin faster than with traditional loans.

Q: “What if my credit isn’t perfect?”

A: Don’t worry! Many contractors offer multiple financing partners with various approval criteria. Some even specialize in helping homeowners with less-than-perfect credit.

Q: “Are there hidden fees?”

A: Reputable contractors provide transparent terms with no hidden costs. Always request a written breakdown of all fees and terms before signing.

Pro Tips for Maximizing Your Financing Benefits

- Time Your Project Right

- Ask about seasonal financing specials

- Look for end-of-year promotions

- Consider bundling projects for better rates

- Leverage Available Incentives

- Check for energy efficiency rebates

- Investigate local improvement grants

- Ask about veteran or senior discounts

- Protect Your Investment

- Review warranty terms carefully

- Consider insurance implications

- Document all agreements in writing

The Future of Roof Financing: What’s Coming in 2024

The industry is evolving rapidly, with new financing options emerging:

- Digital payment platforms

- Mobile-first application processes

- Instant approval technology

- AI-powered credit decisions

Making Your Final Decision: A Success Checklist

✓ Compare at least three financing offers

✓ Review all terms and conditions

✓ Verify contractor credentials

✓ Check customer reviews

✓ Confirm warranty coverage

✓ Understand payment schedule

✓ Document all agreements

Conclusion: Your Next Steps to a New Roof

Don’t let financing concerns keep you from protecting your home. With today’s flexible options from local roofing companies, getting your new roof has never been more accessible.

Take the first step by requesting quotes from reputable local contractors, and ask about their financing programs – you might be surprised at how affordable your new roof can be!